Our business world is facing a growing abundance of fraud risks, especially online. Criminals are becoming more creative every day despite our efforts to prevent them from stealing data. The risks are still high for businesses of all sizes, and it is more important than ever to learn how to detect and prevent fraud before it decapitates our brands.

What is fraud risk management?

If your business has digital channels, which is very likely the case these days, you are at risk of fraud. Every business is. Research by the Federal Trade Commission shows a 70% increase in reported fraud losses between 2020 and 2021 alone.

Still, some companies are more effective than others in detecting and taking the necessary measures to prevent such frauds or at least, mitigate the risks.

Fraud risk management for a business is a process of assessing different risks within a company and using that information to develop a smart program that stops such activities before they happen. In this article, you’ll learn about the most useful ways to detect and prevent suspected fraud in 2022.

Some tips for managing the fraud risks for your business in 2022

Let’s take a look at the must-follow steps for businesses that operate online in 2022.

Recommended for you: Privacy, Security & Health Risks of Social Media & How to Prevent Those.

1. Phase out third-party cookies

Everyone who uses the Internet and visits sites these days is familiar with third-party cookies. But, what are first-party cookies?

In Osano’s guide, these are described as the “online version of a cashier keeping an eye on customers while in the store”. These are codes being generated and stored on a site’s computer that uses algorithms to track data about customer interactions. Such data can include everything from frequency of visits to behaviors on the site to passwords.

Such information is used by businesses to tailor their marketing strategy and make it more personal. Instead of making wild guesses on what the customer intended, this data is shared explicitly and as such, it builds a stronger relationship between the business and its customer.

Most importantly, first-party cookies help you build trust without asking your customers to sacrifice private data.

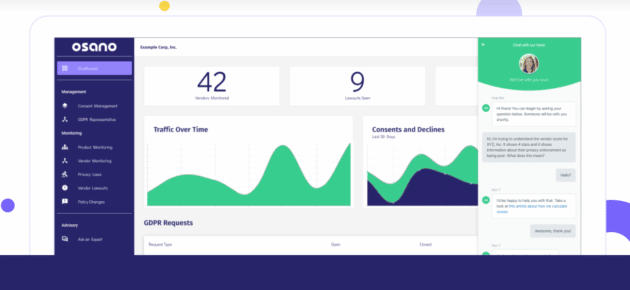

That being said, it is about time that you phase out third-party cookies. If you are ready to do this, Osano is a consent management platform that can facilitate and automate this process for you. You can use it to block or unblock third-party scripts automatically and remain compliant with the regulations in different countries.

Image source: Osano.com.

2. Perform fraud monitoring with a smart tool

Your best chance at detecting and preventing fraud from happening is to monitor for it. But, what is fraud monitoring?

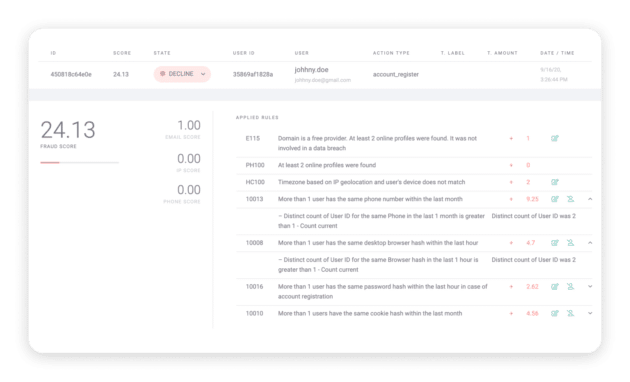

There are tons of things that businesses can keep track of to detect fraudulent activities. Thankfully, tools like SEON make this process much simpler and very efficient. Fraud monitoring tools are software solutions deployed at any moment when the consumer interacts with a product or a service.

Image source: Seon.io.

Such tools assess behaviors and observe real-time data with a focus on touchpoints that can indicate fraud risks for your business. They track activity such as new sign-ups for customers when they log into their account when they proceed to make a payment and enter their card details to checkout, etc.

You can use this tool to perform a variety of tasks including:

- Device and browser fingerprinting.

- Social profiling.

- Digital footprinting.

- IP analysis.

- Behavior analysis.

- Biometrics.

- Velocity checks.

All this data will give you real-time alerts of high-risk behaviors that you can act on to prevent fraudsters from harming your business. It is combined into reports that you can review manually or feed into rulesets and take immediate action.

3. Get a thorough understanding of how payment processing works

One of the most devastating things about online fraud is that it can kill the reputation of your business and bring you unexpected, tremendous costs. If you want to detect and prevent fraud from happening, you need to understand the processes that are most at risk.

This all starts with the payment processing.

The payment processing industry has a straightforward flow:

- An online business i.e. a merchant creates an account with a payment processor or an acquiring bank, which enables them to accept payments.

- The merchant adds a shopping cart to their website which is connected with a payment gateway. When the customer decides to make a purchase, they place the product or service in that shopping cart and are taken to the payment gateway.

- The customer adds their payment details such as credit card number and confirms. When this happens, the captured details such as the name and card numbers are sent to the gateway.

- The payment gateway connects with the acquiring bank by sending a card authorization requesting the transaction amount. This is forwarded to the card network in question such as Visa or Mastercard.

- When the transaction is authorized by the payment provider such as the card network or the bank, the transaction is approved.

It’s amazing how fast these steps are completed nowadays. Legit transactions are processed almost immediately in most cases, even though there might be some exceptions and issues that we’ll be discussing a bit later in this article.

4. Use reliable payment processing systems for card fraud prevention

Credit card fraud is one of the most common types of online fraud these days. In 2018 alone, the US lost $9.47% billion in illegal card transactions.

One of the best ways to protect your business from card fraud is to use a reliable payment processing system. Tracking behaviors is smart, but it is vital that you first make sure that your customers’ payment data is highly encrypted and protected.

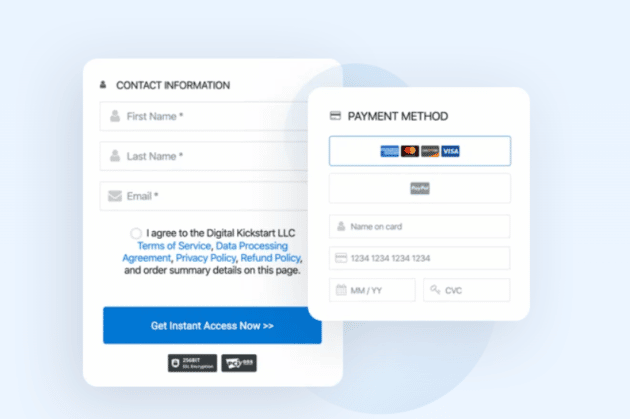

When it comes to credit card fraud detection and prevention, a reliable payment processing partner like PayKickStart can make your online brand much safer and with it, more trusted by customers. PayKickStart’s fraud prevention toolset, Radar is built directly into the payment flow of the website, combined with fierce algorithms that detect patterns across payments.

This tool will help you assess the risk level of every payment, therefore making your website much safer for the customers.

Image source: Paykickstart.com.

5. Ensure that your business is PCI compliant

The PCI refers to the Payment Card Industry Security Standard Council. This council helps businesses protect customers, as well as protect themselves from fraud. The PCI has some of the best and most effective practices in place to protect consumer data.

In most countries, this is mandatory. It is not just up to your preference whether you’ll make your site PCI-compliant – it’s strictly enforced and absolutely necessary.

Since the rules and guidelines change constantly to prevent new fraud risks, your business must keep track of the updates at any point. You can do this on the official website of PCI.

You may like: 12 Types of Endpoint Security Every Business Should Know.

6. Handle those “your payment is declined” issues

All those measures you are taking to ensure that you aren’t a victim of fraud can cause some problems for your customers. Many businesses today limit purchase options to minimize the risk of fraud. They ask for many verification details to ensure that it’s the right person on the other side, etc.

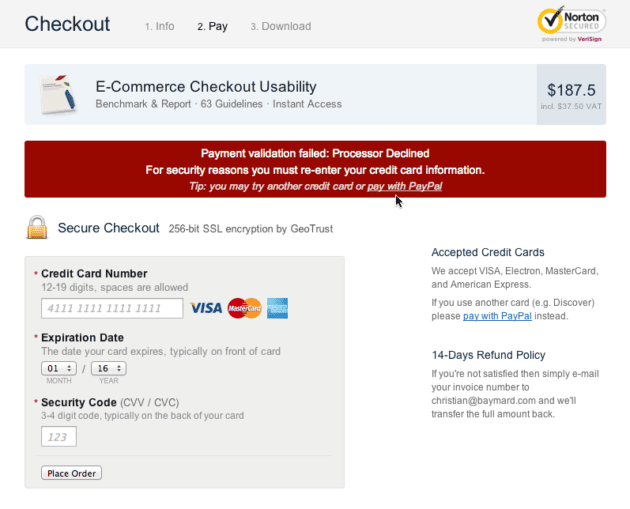

This can cause some “your payment is declined” instances that no one enjoys.

Businesses hate these more than customers. It would be a pity if those efforts you put into making your business website safer from fraud risks make you lose customers because of this.

Do you know how to reclaim lost revenue when such issues occur?

One great way is to provide your customers with more options for making a purchase. If one doesn’t work, they could use another one to complete their goal. For example, if they cannot use their card on your website for some reason, either on your end or the bank’s end, you can offer them the option to use e-wallets.

Image source: Baymard.com.

7. Enforce stronger passwords

Users often get annoyed when they are asked to create big passwords with capital and small letters, numbers, symbols, etc. However, these are required for a reason – to protect businesses and their customers from different kinds of fraud.

Hackers often use software that can hack simple passwords with ease. If you request that your customers create longer, alpha-numeric passwords with special characters and capital letters, you are reducing these risks significantly.

8. Request card verification

By requesting the CVV or Card Verification Value from customers that use credit cards to make their purchases, you will push away many of the fraudsters that use stolen cards online.

Many fraudsters get only the card number and information such as the expiry date. They can only get the CVV if they steal the actual physical card of the customer. If you request the CVV as part of the checkout process, you’ll be eliminating the chance of hackers misusing someone else’s card.

You may also like: Cybersecurity Risk Assessment & Management Tips for Small Businesses.

Are you ready to make your business safer?

The first step toward developing a clear anti-fraud strategy for a business is risk assessment. You can use these steps as precautions to prevent fraud, but also as a way to detect the fraud risks for your business before they become real.

Most businesses don’t see this coming before it is too late. We all think that the chances of it happening to us are slim. Nowadays, businesses of all sizes and industries fall victims to fraud, and this is more common than ever. This means that you should take action – and take it NOW!